Growing a CPG Brand Through Modern Paid Media

/As CPG brands scale, one thing becomes abundantly clear: what got you here won’t get you there. Brands need balanced communications.

For most brands, this means distribution has maxed out. For others, whatever marketing tactic caught fire and helped them grow has hit diminishing returns.

Whichever camp your brand finds itself in (or will find itself in), this is the critical time to have a smart media strategy ready to hit the market.

While the targets of CPG brands, and even where they are bought and consumed, are radically different, there are strategic underpinnings to the brands who grow and those that do not.

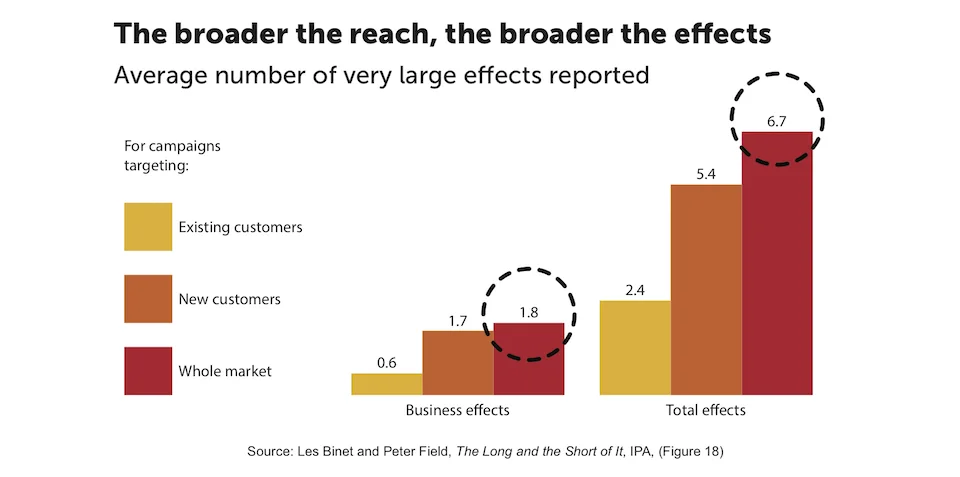

As Les Binet says, having a share of voice above your share of market is an indicator for growth that has remained consistent over decades (and into the 20s).

Paid media is essential in creating this share of voice, and keeping a close eye on your competitive set (e.g. “organic juice” is not a brand’s category, all healthy beverages are) to guide budgets.

This is blunt force trauma, ensuring that you are investing enough to keep pace in your category so that you win at the moment of truth. You want a consumer’s visit to the shelf (physical or online) to be a coronation not a competition.

I also consider Minimum Effective Levels of Awareness (MELA).

I learned this concept firsthand during the launch of Carnation Breakfast Essentials (which relaunched from the iconic Carnation Instant Breakfast) several years back. When the brand stopped advertising, its growth flatlined. With a new brand team in and open to taking a risk, we increased the TV budget and assumed our marketing mix models and actual sales would spike.

It worked, until one day sales stopped growing commensurate to the increase in investment. When we turned TV off, the brand began to contract again. Eventually we zeroed in and what happened to Carnation is what has happened to most classic CPG brands - we discovered the minimum effective level of awareness to keep sales stable.

Knowing scientifically how much media needs to stay on to maintain the brand’s market share on an upward trajectory made sourcing budgets incredibly easy each fiscal year. The penalties for going dark (or staying dark) are too severe.

And I consider the consumer journey. This is always #1, but the journey is evolving.

Most CPG brands are sold at physical retailers and a small combination of e-commerce sites (typically led by Amazon). These brands now know to “stack the deck” at Amazon to drive through a sale with strong advertising share of voice, yet never consider this for the physical store environment.

Mobile apps with relationships to store level and location data allow brands to reach consumers pre-shelf. This proximity is critical in connecting awareness of the brand to seeing it on shelf and actually picking it up.

Bonus: The more awareness you’ve built before consumers get to these environments, the less you will need to invest here.

Don’t forget, it takes a village. Overloading Amazon or a similar platform with advertising units that deliver a high ROAS (even if a consumer was going to buy you anyway), or running high levels of Paid Social just because it gives you analytics, do not make for a sustainable media plan.

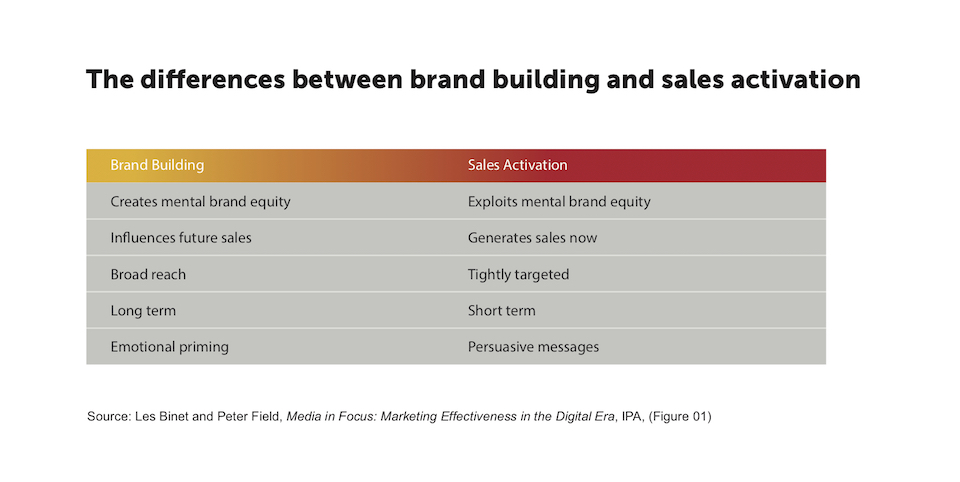

We must stack the deck with awareness driving tactics that build value for the brand, consideration tactics that push consumers to select us, and then lower funnel tactics that close the sale. When one of these elements is removed, the sales process becomes less efficient and misaligned.

Often the solution for CPG brands with stalled growth is to add in the “opposite” media tactic to what the brand is already using (i.e. an all digital brand needs strong traditional awareness and vice versa). This is what reignites growth - not just because a new tactic brings in new consumers, but each tactic makes the others work harder.

As you know by now from my posts, what CPG brands should really seek is balance. Growth requires investment, measurement and deep knowledge of how the consumer buys your category.

Interested in working with Bill? E-mail Bill and set time for a one-on-one meeting.